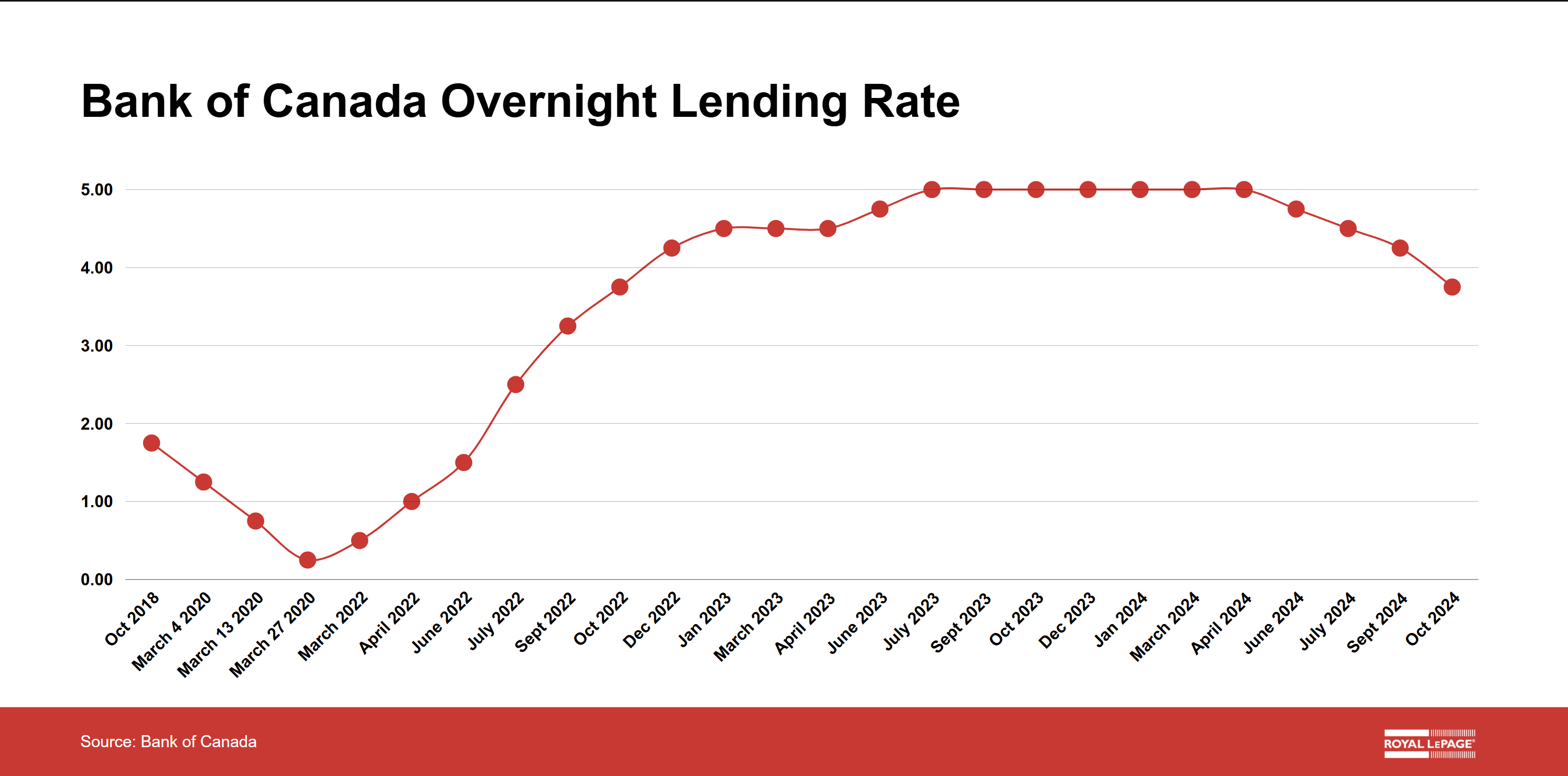

The Bank of Canada has made a significant move by cutting its overnight lending rate by 50 basis points to 3.75%, marking the fourth consecutive reduction this year. This is the largest rate cut since March 2020 and brings the rate below 4% for the first time in two years. The decision was influenced by recent drops in inflation, with September's Consumer Price Index showing a year-over-year increase of only 1.6%, falling below the Bank's 2% target for two months in a row. Governor Tiff Macklem indicated that further cuts might be considered if economic conditions align with forecasts.

The reduced rates are expected to have a positive impact on Canada's housing market, potentially spurring an early spring market. Royal LePage forecasts a 5.5% rise in home prices in Q4 2024, with increased buyer confidence and borrowing power driving demand. Phil Soper, President and CEO of Royal LePage, noted that the rate cut could draw more buyers off the sidelines, especially those with variable-rate mortgages or upcoming renewals, leading to an anticipated surge in market activity. The Bank of Canada’s next rate announcement is scheduled for December 11, 2024.

Read the full October 23rd report here.